The cryptocurrency market is known for its rapid evolution and dynamic nature. As we move through 2024, several key trends are shaping the landscape. These trends reflect technological advancements, market shifts, and emerging opportunities. Here’s a comprehensive look at the current trends in the crypto market.

- Growth of Decentralized Finance (DeFi) 💸🔗

a. Expanding DeFi Ecosystem 📈🌐

New Protocols and Platforms: The DeFi space continues to expand with new protocols offering innovative financial products such as decentralized exchanges (DEXs), yield farming, and liquidity mining. These platforms are increasingly gaining traction, democratizing access to financial services.

b. Integration with Traditional Finance 🏦🔗

Bridging the Gap: More DeFi projects are exploring ways to integrate with traditional financial systems, creating hybrid solutions that combine the benefits of both worlds. This trend aims to enhance liquidity and broaden the adoption of decentralized financial services.

c. Regulatory Scrutiny ⚖️🔍

Compliance and Regulation: As DeFi grows, regulatory bodies are paying closer attention. The sector faces increasing scrutiny regarding compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, which could impact the development and operation of DeFi platforms.

- Rise of Non-Fungible Tokens (NFTs) 🎨🚀

a. Diversification of Use Cases 🌟💡

Beyond Art: NFTs are expanding beyond digital art into areas such as virtual real estate, gaming, and intellectual property. This diversification highlights the growing utility and appeal of NFTs across various sectors.

b. Integration with Metaverse Projects 🕶️🌐

Metaverse Integration: NFTs are increasingly being integrated into metaverse projects, where they represent virtual assets, collectibles, and experiences. This integration is driving new forms of digital interaction and ownership.

c. Market Volatility 📉🔍

Price Fluctuations: The NFT market experiences significant volatility, with prices of digital assets fluctuating based on trends, demand, and market sentiment. Investors should be aware of this volatility when engaging with NFTs.

- Development of Central Bank Digital Currencies (CBDCs) 🏦💰

a. National Initiatives 🌍📜

Global Rollouts: Several countries are progressing with their CBDC projects, aiming to create digital versions of their national currencies. These initiatives are designed to enhance payment efficiency, financial inclusion, and economic stability.

b. Technological and Regulatory Challenges ⚙️🏛️

Implementation Issues: The development and deployment of CBDCs face various challenges, including technological hurdles, regulatory considerations, and public acceptance. Monitoring these developments is crucial for understanding their potential impact on the financial system.

c. Impact on Cryptocurrencies 📉🔄

Market Dynamics: The introduction of CBDCs may influence the demand for cryptocurrencies, potentially affecting their market dynamics and adoption. Observing how CBDCs interact with existing cryptocurrencies will be important for market participants.

- Advancements in Blockchain Technology 🛠️🔗

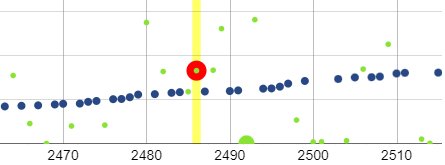

a. Enhanced Scalability Solutions 📈🔧

Layer 2 Solutions and Sharding: Technologies such as Layer 2 solutions (e.g., Rollups) and sharding are being developed to improve blockchain scalability, transaction speeds, and cost-efficiency. These advancements aim to address the limitations of current blockchain networks.

b. Interoperability Enhancements 🌐🔗

Cross-Chain Solutions: Solutions that enable seamless interaction between different blockchain networks are gaining traction. Interoperability improvements are crucial for creating a more connected and functional blockchain ecosystem.

c. Privacy Innovations 🔒💡

Zero-Knowledge Proofs (ZKPs): Privacy-preserving technologies like ZKPs are being integrated to enhance transaction confidentiality and data security. These innovations address growing concerns about privacy in blockchain transactions.

- Growing Institutional Involvement 🏢📈

a. Increased Investment 💼💵

Institutional Adoption: Major financial institutions and corporations are increasing their investments in cryptocurrencies and blockchain technologies. This trend signifies growing mainstream acceptance and the potential for new market opportunities.

b. Development of Institutional Products 📦🏦

New Financial Products: The introduction of products such as Bitcoin ETFs, crypto-backed loans, and institutional custody solutions is expanding investment options and improving market liquidity.

c. Market Impact 📊🔍

Influence on Trends: Institutional involvement can significantly impact market trends, including price movements and the development of new financial products. Understanding institutional influences is key to navigating the crypto market effectively.

- Focus on Environmental Sustainability 🌍🔋

a. Green Blockchain Initiatives 🌿💚

Eco-Friendly Practices: The crypto industry is increasingly focusing on sustainability, with efforts to develop energy-efficient mining practices and reduce carbon footprints. Green blockchain initiatives are becoming more prevalent as environmental concerns grow.

b. Adoption of Renewable Energy ☀️💡

Sustainable Mining: Mining operations are exploring the use of renewable energy sources to mitigate environmental impact. This shift towards sustainability reflects the industry’s response to environmental challenges.

c. Regulatory Pressure ⚖️🔍

Compliance with Environmental Standards: Regulatory bodies are likely to impose stricter environmental standards on cryptocurrency operations. Adhering to these standards will be crucial for maintaining industry credibility and sustainability.

Conclusion 📜🚀

The crypto market in 2024 is characterized by rapid advancements, emerging trends, and evolving challenges. Staying informed about these trends will help investors, developers, and enthusiasts navigate the dynamic landscape and capitalize on new opportunities. 🌟📈

From DeFi and NFTs to CBDCs and environmental sustainability, the developments in the crypto market will shape the future of digital finance and blockchain technology. 🌐🚀