Key takeaways:

- Chainlink could reach a maximum value of $14.20 in 2024.

- By 2027, LINK could reach a maximum price of $32.22.

- In 2030, Chainlink will range between $120.46 to $139.62.

Chainlink (LINK) has emerged as a prominent player in the cryptocurrency market. It provides a decentralized oracle network that connects smart contracts with real-world data. As the adoption of decentralized finance (DeFi) and blockchain technology continues to grow, Chainlink’s innovative solutions have attracted significant attention from investors and developers alike.

Chainlink continues to expand its reach and utility across the blockchain ecosystem, showcasing its robust integration capabilities. Recent updates highlight 14 new integrations of 5 Chainlink services across 10 different blockchain platforms, including prominent names like Arbitrum, Avalanche, and Ethereum. These integrations not only enhance Chainlink’s network but also solidify its position as a critical player in the interoperability and functionality of decentralized applications.

Understanding Chainlink’s potential price movements involves analyzing market trends, technological advancements, partnerships, and overall market sentiment. This price prediction aims to provide insights into Chainlink’s future performance by examining both technical analysis and fundamental aspects that could influence its value.

Overview

| Cryptocurrency | Chainlink |

| Token | LINK |

| Price | $10.84 |

| Market Cap | $6,589,638,511 |

| Trading Volume | $123,116,586 |

| Circulating Supply | 608,099,970 |

| All-time High | $52.88 May 09, 2021 |

| All-time Low | $0.1263 Sep 23, 2017 |

| 24-h High | $11.19 |

| 24-h Low | $10.81 |

Chainlink price analysis: LINK hovers near key support amid market uncertainty

Key takeaways:

- Chainlink price analysis shows a potential for a rebound if it rises above $10.88.

- The $10.88 EMA signals a strong foundation for recovery in the Chainlink market.

- Technical indicators hint at upward upward movement if key support levels hold firm.

Chainlink price analysis as of September 15, 2024, reveals Chainlink (LINK) trades at $11.21, exhibiting slight bearish pressure with a 0.53% decline over the last 24 hours. This slight drop comes amidst a trading volume of $121.45 million, indicating active market participation. The daily chart’s price movement suggests a consolidation following a more extensive downtrend that peaked around mid-June. The 10-day Exponential Moving Average (EMA) at $10.888 provides immediate support, signaling some stability after recent fluctuations.

Chainlink daily chart analysis: LINK nears critical support at $10.0

Chainlink (LINK) displays a nuanced trajectory on the daily chart, with the current price hovering at $11.19. This movement places LINK near a crucial support level at $10.88, defined by the 10-day Exponential Moving Average (EMA). This period has been characterized by upward and downward movements, suggesting a market grappling with internal and external influences. A closer examination reveals that following a peak in June, LINK has generally trended downwards, although recent weeks show attempts at recovery.

The Relative Strength Index (RSI) for Chainlink stands at 54.92, indicating a neutral position with neither overbought nor oversold conditions. This neutrality points to an undecided market, potentially awaiting further cues. Meanwhile, the Stochastic RSI, a momentum oscillator that measures the level of the close relative to the high-low range over a set period, shows a promising uptick, with readings at 91.84 for %K and 94.32 for %D, suggesting that short-term buying pressure has been significant but might soon reach overbought territory.

Looking ahead, the key for Chainlink will be its ability to maintain support at the $10.88 EMA level. Should LINK sustain above this threshold, it may establish a foundation for a potential rebound, particularly if broader market sentiments shift positively. However, failure to hold above this EMA could see LINK testing lower supports, possibly around the $10.50 mark, before any significant recovery can occur.

Chainlink 4-hour chart analysis: LINK shows resilience with bullish undercurrents

The 4-hour Chainlink (LINK) chart presents an intriguing scenario for traders as it oscillates around key technical levels. This comes after a recent upswing where LINK tested the upper boundaries of the Bollinger Bands, indicating an increase in volatility and buying pressure. The Moving Average Convergence Divergence (MACD) is currently just below the baseline, but with the histogram ticking higher, a potential bullish crossover could be imminent if buying momentum continues. This subtle shift in momentum is noteworthy, especially after prolonged bearish dominance that saw LINK retract significantly from higher levels.

The rebound from the lower Bollinger Band and the stabilization above the 20-period Simple Moving Average (SMA) at $11.111 shows that buyers are defending the recent gains, creating a support zone that could propel LINK higher if sustained. The price’s ability to maintain above this moving average and the midline of the Bollinger Bands could signal a strengthening in buyer confidence, potentially leading to tests of resistance levels near $11.50. The immediate trading sessions will be crucial in determining whether LINK can maintain its upward trajectory or if it will succumb to selling pressures, revisiting lower support levels around $11.00.

Chainlink price prediction: Technical analysis

| Metric | Value |

| Price Prediction | $ 7.77 (-28.54%) |

| Volatility | 7.27% |

| 50-Day SMA | $ 12.08 |

| 14-Day RSI | 46.69 |

| Sentiment | Bearish |

| Fear & Greed Index | 26 (Fear) |

| Green Days | 14/30 (47%) |

| 200-Day SMA | $ 15.45 |

Chainlink technical indicators: levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

| SMA 3 | $10.63 | BUY |

| SMA 5 | $10.87 | SELL |

| SMA 10 | $11.48 | SELL |

| SMA 21 | $11.16 | SELL |

| SMA 50 | $12.08 | SELL |

| SMA 100 | $13.57 | SELL |

| SMA 200 | $15.45 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

| EMA 3 | $10.88 | SELL |

| EMA 5 | $10.68 | BUY |

| EMA 10 | $10.58 | BUY |

| EMA 21 | $10.94 | SELL |

| EMA 50 | $12.06 | SELL |

| EMA 100 | $13.29 | SELL |

| EMA 200 | $14.02 | SELL |

What to expect from Chainlink

Given the current setup, Chainlink faces immediate resistance at the $11.00 level. The consolidation around $10.70 suggests that the market is undecided, with potential for a breakout above this resistance or further declines if the support around $10.60 fails. The Aroon indicator’s current readings support the possibility of further downward movement, which would need to be closely monitored for signs of a stronger bearish trend developing.

Is Chainlink a good investment?

Chainlink represents a robust investment opportunity due to its pivotal role in linking external data to blockchains through its decentralized oracle network, which is crucial for the functionality of smart contracts, especially in DeFi. Its strategic collaborations with major blockchain platforms and traditional finance entities, such as Coinbase Cloud, enhance its reliability and expand its use cases across various industries. This interoperability and the essential nature of its services position Chainlink as a key player in the blockchain ecosystem, making it an attractive option for investors looking for growth potential in the cryptocurrency market.

Will Chainlink recover?

Chainlink’s price has declined recently, with minor short-term recoveries; however, the move is gradual. The general trend remains bearish as it seeks support.

Will Chainlink reach $50?

Chainlink current price shows a decline with some stabilization, predicting whether Chainlink will reach $50 is uncertain.

Will Chainlink reach $100?

It is highly speculative for Chainlink LINK price prediction of Chainlink to reach $100.

Does Chainlink have an excellent long-term future?

Chainlink shows some stabilization and potential for recovery, indicating the token may have a promising long-term future.

Recent news/opinion on Chainlink

- Suhoio and chainlink establish strategic alliance to enhance tokenized assets and CBDC utilization.

- Chainlink partners with Instruxi.io to enhance SDK with secure, real-time data functions.

Chainlink price prediction September 2024

Chainlink’s price is estimated to be between $10.86 and $11.72 in September 2024, and its average cost is expected to be around $11.32.

| Chainlink Price Prediction | Potential Low ($) | Average Price ($) | Potential High ($) |

| Chainlink price prediction September 2024 | $10.86 | $11.32 | $11.72 |

Chainlink price prediction 2024

After analyzing the LINK prices in previous years, it is assumed that by the end of 2024, the minimum price of LINK will be around $12.72. The maximum expected LINK price may be around $14.20. On average, the trading price might be $13.16.

| Chainlink Price Prediction | Potential Low ($) | Average Price ($) | Potential High ($) |

| Chainlink price prediction 2024 | $12.72 | $13.16 | $14.20 |

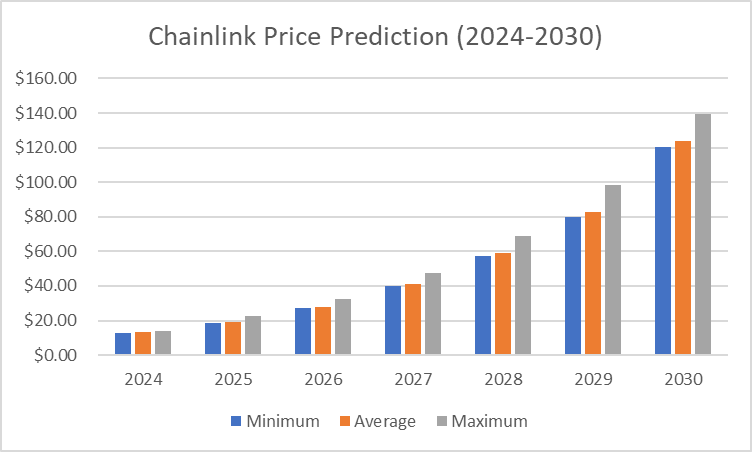

Chainlink price prediction 2025-2030

| Year | Minimum | Average | Maximum |

| 2025 | $18.78 | $19.30 | $22.64 |

| 2026 | $27.08 | $28.04 | $32.22 |

| 2027 | $40.02 | $41.14 | $47.37 |

| 2028 | $57.55 | $59.20 | $68.98 |

| 2029 | $79.77 | $82.73 | $98.43 |

| 2030 | $120.46 | $123.77 | $139.62 |

Chainlink price prediction 2025

In 2025, Chainlink is expected to reach a maximum value of $22.64, a minimum price of $18.78, and an average value of $19.30.

Chainlink price prediction 2026

The price of Chainlink is expected to reach a minimum level of $27.08 in 2026. The LINK price can reach a maximum level of $32.22, with an average price of $28.04.

Chainlink price prediction 2027

The price of Chainlink is predicted to reach a minimum level of $40.02 in 2027. The Chainlink price can reach a maximum level of $65.89, with an average price of $58.78.

Chainlink price prediction 2028

The Chainlink price prediction for 2028 suggests a minimum price of $57.55 in 2028, a maximum price of $68.98 and an average forecast price of $59.20.

Chainlink price prediction 2029

In 2029, Chainlink is expected to reach a maximum value of $98.43, a minimum price of $79.77, and an average value of $82.73.

Chainlink price prediction 2030

The price of Chainlink is predicted to reach a minimum value of $120.46 in 2030. Investors can anticipate a maximum price of $139.62 and an average trading price of $123.77 if the bulls hold position.

Chainlink market price prediction: Analysts’ LINK price forecast

| Firm | 2024 | 2025 |

| Gov.Capital | $27.41 | $53.94 |

| DigitalCoinPrice | $23.83 | $28.04 |

| Coindex | $23.00 | $ 27.78 |

Cryptopolitan’s Chainlink price prediction

According to our Chainlink price forecast, the coin’s market price might reach a maximum value of $13 by the end of 2024. In 2026, the value of LINK could surge to the $30 region.

Chainlink’s historic price sentiment

Chainlink, launched in September, and it initially traded at around $0.20.In 2018,the token saw moderate growth, occasionally spiking, but generally stayed under $1.00 for most of the year.

- In 2019 significant growth occurred, with LINK’s price reaching $1.00 in May and peaking at approximately $3.00 by the end of the year. This was driven by increased recognition of its utility in providing secure and reliable data feeds for smart contracts.

Rapid Growth and Volatility (2020-2021)

- 2020: A standout year, LINK started around $2.00, surging to $20 by August, catalyzed by the explosive interest in DeFi applications, where Chainlink’s oracles were crucial.

- 2021: The price reached an all-time high of around $52 in May, driven by continued DeFi expansion and broader crypto market rallies. However, it later experienced significant volatility, dropping back down to around $22 by mid-year.

Correction and Stabilization (2022-2023)

- 2022: The market correction affected LINK as well, with prices mostly ranging between $15 and $25, reflecting the broader downturn in cryptocurrency markets.

- 2023: A further decrease saw prices stabilize in a lower range of $6 to $13 throughout the year, as the market adjusted and investor sentiment cooled off.

Current Chainlink price Performance (2024)

- The year began with LINK priced around $15, with a temporary spike to about $18 in early months. In 2024, Chainlink (LINK) exhibited significant volatility, opening the year around $15 and briefly surging to $18 in February.

- The momentum could not be sustained, and by April, the price had declined to around $12 amidst broader market corrections.

- Throughout the middle of the year, LINK’s price fluctuated, peaking again near $15 in May before a gradual descent took it to lows near $10 by August.

- As of September, the cryptocurrency has shown signs of stabilization, albeit in a lower trading range just below $11.