As cryptocurrencies become increasingly mainstream, understanding their tax implications is crucial for both investors and businesses. Tax regulations for cryptocurrencies can vary widely by country, but there are some common principles and practices that can guide you. This article provides an overview of the key considerations and guidelines for the taxation of cryptocurrencies.

🔍 Understanding Cryptocurrency Taxation

Nature of Cryptocurrency Transactions

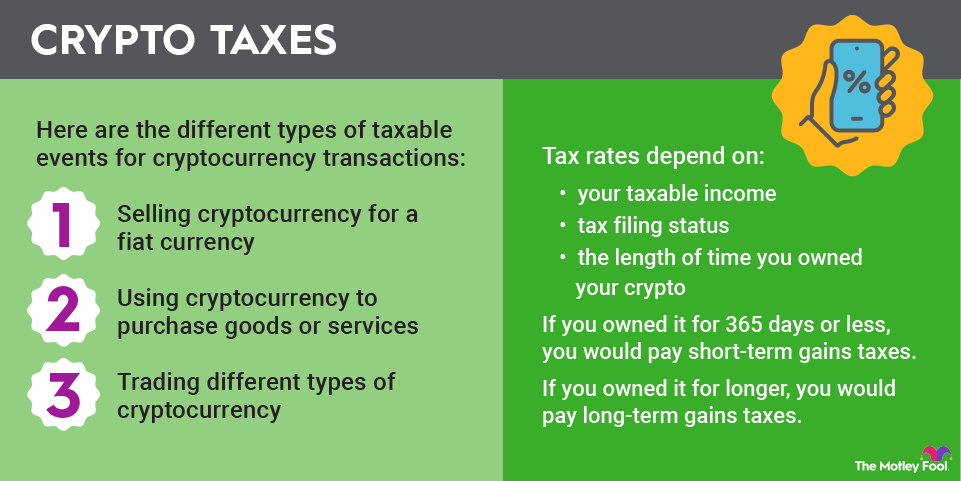

Issue: Cryptocurrencies can be used for various types of transactions, including buying goods and services, trading, and investing. Each type of transaction may have different tax implications.

Guideline: In many jurisdictions, cryptocurrencies are treated as property rather than currency. This means that transactions involving cryptocurrencies may be subject to capital gains tax or income tax, depending on the nature of the transaction.

Capital Gains Tax

Issue: When cryptocurrencies are sold or exchanged for a profit, the gain is generally subject to capital gains tax. This tax is based on the difference between the purchase price and the selling price.

Guideline: Keep detailed records of all cryptocurrency transactions, including dates, amounts, and prices. This information will be necessary to calculate capital gains or losses. The tax rate may vary depending on how long the cryptocurrency was held (short-term vs. long-term).

Income Tax

Issue: If cryptocurrencies are received as payment for services or mining, the value of the cryptocurrency may be considered taxable income.

Guideline: Report any cryptocurrency received as income at its fair market value on the date of receipt. This value should be included in your gross income for tax purposes.

Trading and Speculative Gains

Issue: Frequent trading of cryptocurrencies may be considered speculative, and gains from such activities might be subject to different tax rules.

Guideline: Traders should be aware of the specific tax regulations related to trading and ensure accurate reporting of their gains and losses. Some jurisdictions may treat frequent trading as a business activity, which could affect the tax treatment of gains.

Mining and Staking

Issue: Cryptocurrencies obtained through mining or staking are generally considered taxable income.

Guideline: Report the fair market value of mined or staked cryptocurrencies as income at the time they are received. Additionally, if you later sell or exchange these cryptocurrencies, you will need to calculate and report any capital gains or losses.

Airdrops and Forks

Issue: Receiving cryptocurrencies through airdrops or as a result of a blockchain fork can have tax implications.

Guideline: In many jurisdictions, the value of cryptocurrencies received through airdrops or forks is considered taxable income. The value should be reported at the time of receipt, and any subsequent gains or losses from the sale or exchange should be tracked and reported.

Record-Keeping and Reporting

Issue: Proper record-keeping is essential for accurate tax reporting and compliance.

Guideline: Maintain detailed records of all cryptocurrency transactions, including purchase and sale dates, amounts, values, and any associated fees. Use this information to accurately report your taxable gains and losses.

International Considerations

Issue: Cryptocurrency tax regulations can differ significantly between countries, and international transactions may have additional reporting requirements.

Guideline: Be aware of the tax regulations in your country of residence as well as any other jurisdictions where you conduct cryptocurrency transactions. Consider consulting with a tax professional who has experience with international cryptocurrency tax issues.

Conclusion: Navigating Cryptocurrency Taxation

Navigating the tax implications of cryptocurrency transactions can be complex, but understanding the basic principles can help you ensure compliance and avoid potential issues. By keeping detailed records, reporting income and gains accurately, and staying informed about relevant regulations, you can manage your cryptocurrency tax obligations effectively. Always consider seeking advice from a tax professional to address specific issues