Key takeaways

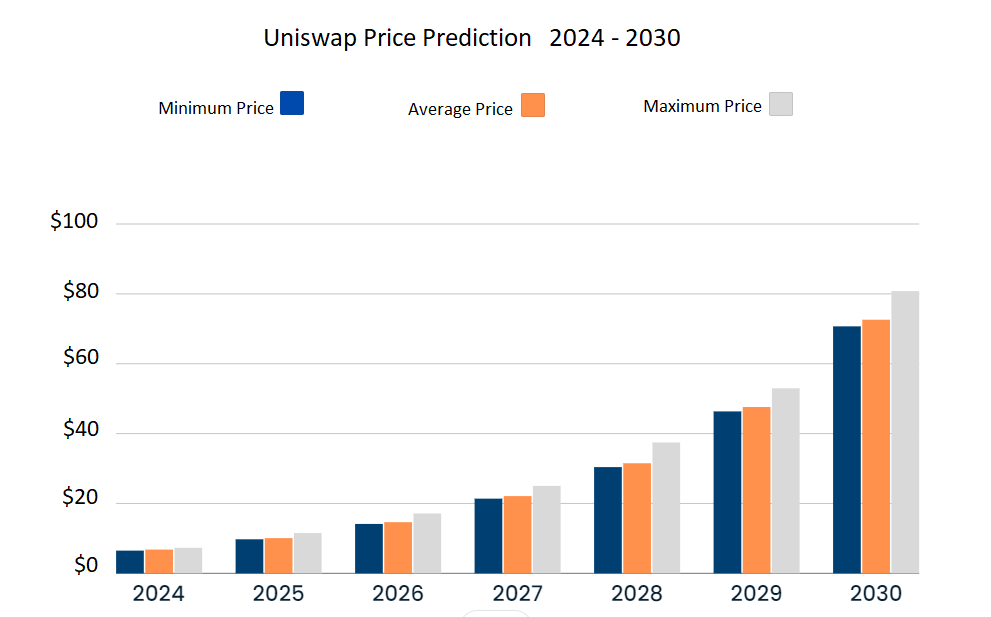

- Uniswap (UNI) might reach as high as $7.30 by 2024.

- Estimates for Uniswap’s average price in 2027 range from $21.38 to $25.03.

- UNI’s average price in 2030 will be $72.60, with a maximum price of $80.79.

Uniswap, a DeFi protocol founded in 2018 by former mechanical engineer Hayden Adams. The Uniswap exchange is a 100% on-chain automated market maker (AMM) protocol on the Ethereum blockchain. The AMM allows DeFi users to swap ether (ETH) for any ERC-20 token without intermediaries, solving many liquidity problems most exchanges face. Uniswap’s unique features and utility make its token, UNI, attractive to traders and investors.

Will UNI reach $100? How high can UNI go in five years? Let’s take a look at Uniswap’s technical analysis and price prediction to provide answers to these queries.

Overview

| Cryptocurrency | Uniswap |

| Abbreviation | UNI |

| Current Price | $6.574 |

| Market Cap | $3,955,237,843 |

| Trading Volume | $109,928,767 |

| Circulating Supply | 600,210,150 UNI |

| All-time High | $44.97 May 03, 2021 |

| All-time Low | $0.419 Sep 17, 2020 |

| 24-hour High | $6.89 |

| 24-hour Low | $6.41 |

Uniswap price prediction: Technical analysis

| Metric | Value |

| Volatility (30-day Variation) | 6.41% |

| 50-Day SMA | 6.90 |

| 200-Day SMA | 8.76 |

| Sentiment | Bearish |

| Fear & Greed | 26 (Fear) |

| Green Days | 16/30 (53%) |

Uniswap price analysis: Coin value declines below $6.574 margin

TL;DR Breakdown:

- Uniswap price analysis confirms a downward trend at $6.574.

- Coin value has lost up to 5.36% of value during the day.

- UNI prices are seeking resistance around the $7.101 border.

On September 18, 2024, Uniswap revealed a downward trend for the cryptocurrency. It has dropped to $6.574 during the past 24 hours. If observed throughout, the UNI coin has devalued up to 5.36% today. Despite the upswing yesterday, today the bears have regained their strength significantly.

Uniswap price analysis on a daily time frame

The 1-day price chart of Uniswap confirmed a downtrend for the currency today. The coin value has decreased to a $6.574 low in the past 24 hours. Moreover, the market sentiment remained negative. The coin value has now receded below its moving average amidst the growing decline.

The gap between the Bollinger bands dictates market volatility. As this gap is currently converging, it marks a lower market unpredictability. The upper limit of the Bollinger bands indicator is at $7.101, confirming the resistance threshold. The lower limit is at $5.715, securing support.

The Relative Strength Index (RSI) indicator resides within the neutral region. Its value has decreased to 51.26 amidst the growing downside. This decreasing movement of the RSI indicator refers to a bearish market. If the selling activities continue to grow, the market can experience further instability.

Uniswap price analysis on a 4-hour chart: UNI launches past $6.573 hurdle

The four-hour price analysis of Uniswap confirms an increasing trend for the cryptocurrency. Currently trading at $6.573 and still moving upwards, this confirms a bullish trend. As the coin value continues to ascend, there is a higher chance of further recovery. A green candlestick on the four-hour price chart marks a bullish victory.

The Bollinger bands are converging, signaling a decline in market volatility. This decline refers to lower market unpredictability for now. Moreover, the upper limit of the Bollinger bands indicator, acting as resistance, is at $6.904. whereas the lower limit of the Bollinger bands indicator, serving as support, is at $6.259.

The RSI indicator is situated within the neutral region at 47.99. Its value is on the increasing side following the recent bullish strike. The ascending curve on the RSI graph marks an upward trend. Moreover, if the buying activities continue to overpower the selling activities, further ascent in the RSI may be observed soon.

Uniswap technical indicators: Levels and action

Daily Simple Moving Average

| Period | Value ($) | Action |

| SMA 3 | 5.87 | BUY |

| SMA 5 | 5.92 | BUY |

| SMA 10 | 6.12 | BUY |

| SMA 21 | 6.40 | SELL |

| SMA 50 | 6.90 | SELL |

| SMA 100 | 8.21 | SELL |

| SMA 200 | 8.76 | SELL |

Daily Exponential Moving Average

| Period | Value ($) | Action |

| EMA 3 | 6.25 | SELL |

| EMA 5 | 6.28 | SELL |

| EMA 10 | 6.29 | SELL |

| EMA 21 | 6.47 | SELL |

| EMA 50 | 7.17 | SELL |

| EMA 100 | 7.87 | SELL |

| EMA 200 | 8.09 | SELL |

What to expect from Uniswap price analysis next?

Uniswap price analysis for the day confirms a highly bearish prediction for the currency. UNI coin has devalued to $6.574 low amidst the growing bearish strength. Overall, the coin value has experienced up to 5.37% of loss during the day. If the selling pressure continues to gain intensity, the cryptocurrency may undergo further losses. Technical indicators are giving out a neutral signal; however, the price charts are supporting the bears. Moreover, the four-hour price analysis confirms minor signs of bullish recovery.

Is Uniswap a good investment?

Uniswap is a decentralized cryptocurrency exchange (DEX) with massive potential. Unlike traditional exchanges, Uniswap uses an automated market-matching (AMM) system. Uniswap has shown good performance over time and is expected to reach the $38 level by 2027 and above $100 by 2030.

Why is UNI down?

The broader crypto market is experiencing a bearish spell. Most of the top cryptocurrencies are losing money, and so is UNI. The cryptocurrency has lost more than 5.37 percent of its value over the last 24 hours, and its price has decreased to $6.574.

Will UNI reach $20?

Uniswap is trading near the $8 range, down from $15.3, which it achieved in March this year. The current resistance levels are $10 and $12; a break above them can lead to $15. If UNI gets more support, $20 can be achieved by 2026.

Will UNI reach $50?

In May 2021, UNI touched $44.9, its all-time high and not much below $50. This possibility can arise again if the broader cryptocurrency market turns bullish on political and economic factors.

Will UNI reach $100?

According to Cryptopolitan’s price prediction, UNI is expected to reach $100 by the second quarter of 2030. Though this is a five-year time frame, it’s worth waiting as the coin’s value will increase more than tenfold in this scenario.

Does UNI have a good long-term Future?

UNI is the token of the famous Uniswap decentralized exchange. It has a wide user base and good liquidity, so the coin has good prospects. Cryptopolitan expects UNI’s price to reach $109 by the end of 2030, substantially higher than its current price.

Recent news/Opinions on Uniswap Network

- Claims that the Uniswap platform charges $20 million for protocol deployments have been disputed by CEO Hayden Adams, who referred to it as “completely false.” On September 12, 2024, Adams clarified that protocol deployments normally come after a governance vote, adding that he seldom interacts with people who are looking for attention. He continued by saying that deployments are ranked according to the activity and effort involved, while attempts are being made to lower the amount of work needed per chain.

Uniswap price prediction September 2024

For September 2024, UNI shows an ability to swing wildly; the anticipated minimum value of Uniswap is $5.43. The price may jump to $7.12, but the average trading price of $6.30 is expected throughout the month.

| Month | Potential Low ($) | Average Price ($) | Potential High ($) |

| September 2024 | $5.43 | $6.30 | $7.12 |

Uniswap price prediction 2024

For 2024, UNI’s price might reach a maximum of $7.30, which is over 20% higher than the current price. The minimum price is expected to be $6.50, with the year’s average trading price estimated at around $6.80.

| Month | Potential Low ($) | Average Price ($) | Potential High ($) |

| 2024 | $6.50 | $6.80 | $7.30 |

Uniswap price predictions for 2025-2030

| Year | Potential Low | Average Price | Potential High |

| 2025 | $9.74 | $10.08 | $11.53 |

| 2026 | $14.14 | $14.64 | $17.14 |

| 2027 | $21.38 | $22.11 | $25.03 |

| 2028 | $30.41 | $31.51 | $37.48 |

| 2029 | $46.35 | $47.61 | $52.97 |

| 2030 | $70.70 | $72.60 | $80.79 |

Uniswap price prediction 2025

For 2025, Uniswap is projected to have a minimum price of $9.74. The price could soar up to $11.53, with an average of $10.08.

UNI price prediction 2026

For 2026, Uniswap’s price is projected to have a minimum value of $14.14. The price could soar up to $17.14, with an average of $14.64.

Uniswap (UNI) price prediction 2027

In 2027, the price of UNI is anticipated to hit a minimum of $21.38. The maximum price might reach $25.03, with an average trading value of $22.11.

Uniswap price prediction 2028

The 2028 forecast for Uniswap predicts a minimum price of $30.41 and a maximum of $37.48, with an average price of $31.51.

Uniswap price forecast 2029

The price of Uniswap in 2029 is expected to start at a minimum UNI price of $46.35 and climb to $52.97 while averaging $47.61.

Uniswap (UNI) price prediction 2030

For 2030, the minimum projected price for Uniswap is $70.70. Traders can expect a maximum price of $80.79 and an average of $$72.60, as per Uni coin price prediction.

UNI market price prediction: Analysts’ UNI price forecast

| Firm Name | 2024 | 2025 |

| DigitalCoinPrice | $20 | $25.29 |

| Wallet Investor | $9.89 | $27.162 |

| Coincodex | $ 24.38 | $ 25.29 |

Cryptopolitan’s Uniswap price prediction

Our price prediction for Uniswap shows that UNI will reach a high of $9.20 near the end of 2024. 2025 it will trade between an expected range of $12.03 and $14.30. In 2030, UNI will range between $75.16 and $91.38, with an average price of $77.81. It is important to consider that the predictions are not investment advice. Professional consultation is suggested, or you can carry out your own research.

Uniswap historic price sentiment

- Uniswap (UNI) token launched on September 17, 2020, starting at $3.00. It quickly rose to $7.00 before reaching an all-time low of $1.03 (CoinGecko) or $0.4190 (CoinMarketCap) on the same day. UNI ended the year at $5.00 after a gradual recovery during the 2020 bull run.

- In 2021, UNI surged 400% in January to $20. By March, it hit $28, and on May 3, reached an all-time high (ATH) of $44.93. It ended the year near $18 after a significant decline.

- Throughout 2022, UNI continued to decline, dropping to around $5.5 by June as the bearish trend persisted.

- The crypto market rebounded in 2023, and UNI saw bullish momentum, peaking at $7.77 on December 28.

- UNI began 2024 on a downtrend, briefly recovering to $15 by March 6. After mid-May, it faced selling pressure, falling to $0.14 by July 31. It stabilized in August around $5 and traded above $6 at the start of September.